Custom house, Dhaka is working under the umbrella of National Board of Revenue (NBR) which is the apex body for direct and indirect tax revenue in Bangladesh. NBR is the major organ of Internal Resources Division (IRD) under the ministry of Finance, Government of Bangladesh. Dhaka Custom House is the largest airport customs station of Bangladesh. It is located in Kurmitola which is northern Part of Dhaka city. It's primarily responsible for collection of all duties and taxes at the import stage. Apart from collection of government revenue it also passenger service of airport and trade facilitation, enforcement of government laws & regulations, Protection of public health cultural heritage environment ensures outgoing & incoming trade compliance.

To provide passenger services to incoming and outgoing passengers through Hazrat Shahjalal International Airport besides collection of customs duty on imported and exported goods by air and to prevent smuggling including collection of customs tax in the light of applicable rules and regulations under the Commissioner of Custom House, Dhaka through the following 4 shifts 24/7 (Hour/Day) activities are being conducted.

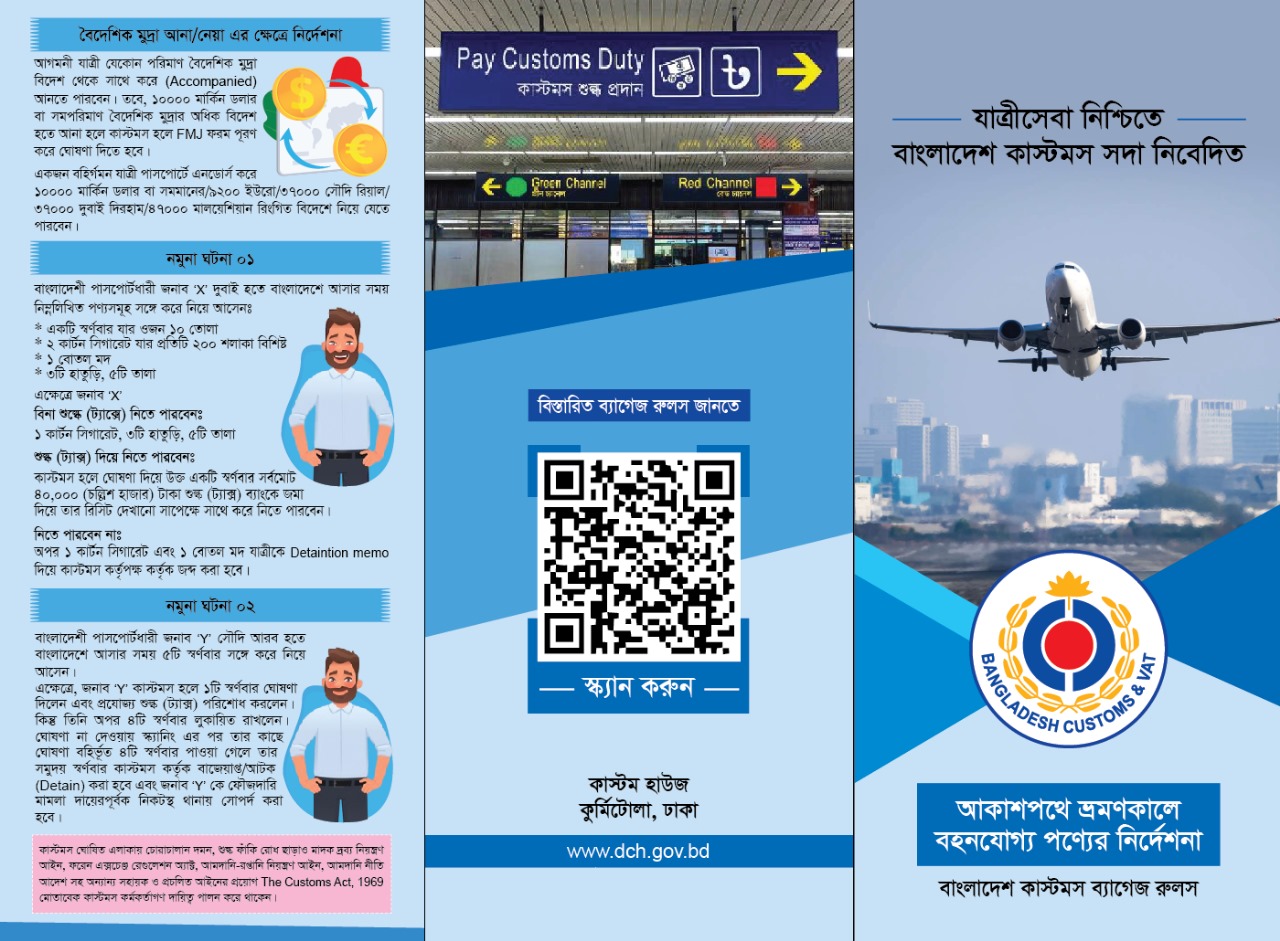

In order to ensure passenger service, arriving/departing passengers by air must be aware of the existing baggage rules. below are mentioned the existing provisions in phases.

Emergency Contact: Airport customs (Mike -14) 01318477941

a) What goods can a passenger carry tax free by air?

A passenger can bring 01 of the following goods free of duty (tax) at the baggage facility from abroad: [Schedule-3]*

b) What goods can be brought in dutifully (without penalty) by a passenger?

**S.R.O. No. 261-Act/2025/71/Customs (02 June, 2025 AD)

c) To be carried out on redemption of baggage not brought with the passenger:

Unaccompanied Baggage (Unaccompanied Baggage) subject to compliance with the rules can be exempted from duty by providing a proper declaration. The declaration form (Schedule-1) is given to the passengers in the aircraft before landing or is available at customs.

By mistake: or due to unavoidable reasons, if it is not possible to make the declaration before leaving the customs hall, the declaration must be made at the customs house adjacent to the airport within 07 (seven) days of the passenger's arrival. A copy of the declaration must be submitted to the airport customs officer at the time of baggage release.

d) Necessary instructions for carriage of gold:

A passenger can carry a maximum of 117 grams or 10 tola of gold by declaring it at the customs and paying the following customs duties:

Customs tax on every 11.664 grams of gold = 5,000/- Taka

Customs tax on every 117 grams of gold = 50,000/- Taka (approximate)

Any amount of gold in excess of 117 grams will be confiscated/detained by the customs authorities. Carrying any amount of gold bars or gold ingots or gold other than bullion without declaration is completely illegal. Passengers carrying undeclared gold will be detained, arrested and a criminal case will be filed and handed over to the nearest police station. A passenger can carry a maximum of 117 grams or 1 (one) gold bar worth 10 tola only once per year after declaring it at the customs.

e) Instructions for carrying cigarettes:

A person can carry a maximum of 1 carton or 200 cigarettes for his personal needs. Any amount of cigarettes or any amount of Vape or Liquid Nicotine in excess of 1 cut/200 shalak will be seized/detained by customs authorities.

f) Instructions for carrying Liquor:

No Bangladeshi passport holder can carry alcoholic beverages. All such imported liquor shall be seized/detained by the Customs authorities. However, a foreign passport holder can bring up to one liter of liquor or alcoholic beverages (eg: spirits, beer etc.) duty free.

g) In case of carrying mobile set:

A passenger can import 2 (two) used mobile phones and 1 (one) new mobile phone only once per year without paying duty and tax, however, Rule 10 and other prevailing rules and regulations will apply to mobile phones imported in excess of this.

h) Instructions in respect of additional goods carried with passengers:

Goods carried are exempt from payment of duties/taxes unless considered commercial. However, any quantity of goods brought for commercial purposes will be seized/detained by the customs authorities.

j) To be done in case of carrying Laptop/Computer:

A passenger can bring an old/new laptop/computer with him (Accompanied).

(j) Instructions on carrying firearms:

The carrying of all types of firearms by passengers is completely prohibited. However, subject to the approval of the Ministry of Commerce, a passenger can carry an airgun/air rifle with a tax of Tk 5,000.

k) Instructions regarding import/removal of foreign currency:

Incoming passengers can bring any amount of foreign currency accompanied (Accompanied) from abroad. However, if more than USD 10,000 or an equivalent amount of foreign currency is brought from abroad, the FMJ form must be filled out and declared at customs. In the case of outbound passengers, the foreign currency should be endorsed in the passport.

Note: Customs officials are responsible for the enforcement of the Customs Act, 1969, along with other ancillary and customary laws including the Narcotics Control Act, Foreign Exchange Regulation Act, Import-Export Control Act, and Import Policy Order, in addition to the suppression of smuggling, prevention of duty evasion in the declared areas.

Customs Instruction file: